A Decrease in Business Taxes Will Tend to

Students who viewed this also studied. The IRS wants to increase the tax rate on the business side so that you can deduct more of your profits.

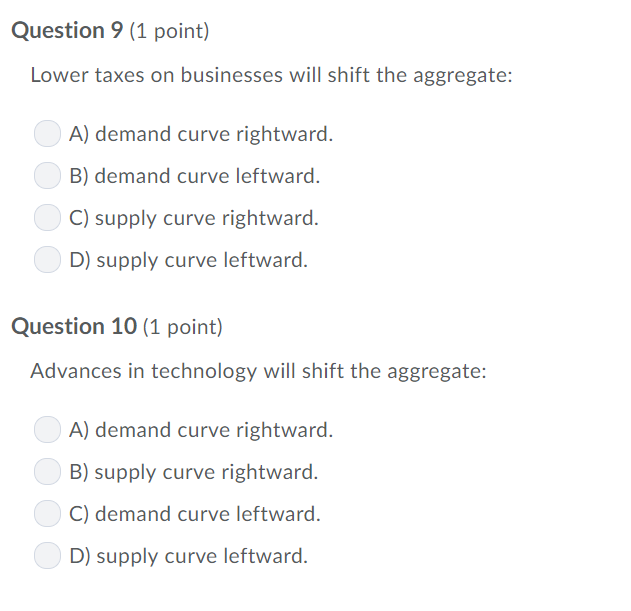

Solved Question 9 1 Point Lower Taxes On Businesses Will Chegg Com

This will likely result in more money going to the government but it will likely also result in companies like Amazon Apple and Google to be forced to pay more so that they can keep the profits they make.

. Increase aggregate demand but not change aggregate supply B. A decrease in business taxes will tend to A increase aggregate demand but not A decrease in business taxes will tend to a increase School Angelo State University Course Title ECON 6311 Type Test Prep Uploaded By Sangmin Pages 30 Ratings 50 4 This preview shows page 18 - 20 out of 30 pages. View full document See Page 1 78.

O Increase aggregate supply but not change aggregate demand. View full document See Page 1 102. Generally the TOF rate is lower than the capital gains rate so the tax that you pay on your profits is called the capital gains tax CGT.

Up to 256 cash back azurearmadillo867 Lv1 28 Nov 2020 A decrease in business taxes will tend to A Decrease aggregate supply and decrease aggregate demand B Increase aggregate supply but not change aggregate demand C Increase aggregate demand and increase aggregate supply D None of the above Show full question Answer 20 Watch. If Andrew sells the house for 120000 he will have a 20000 gain because he must. View full document See Page 1.

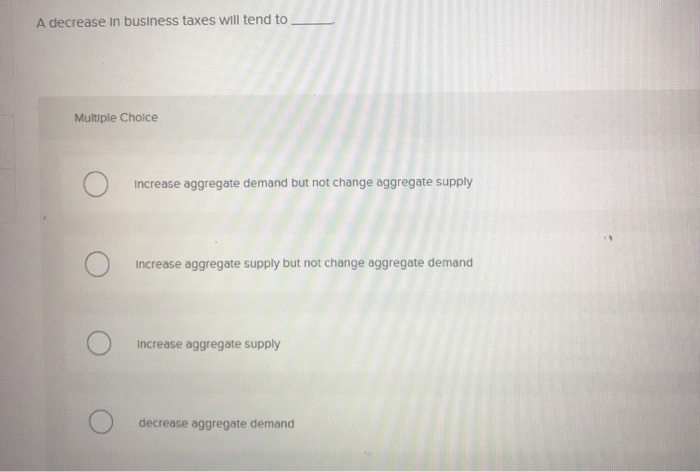

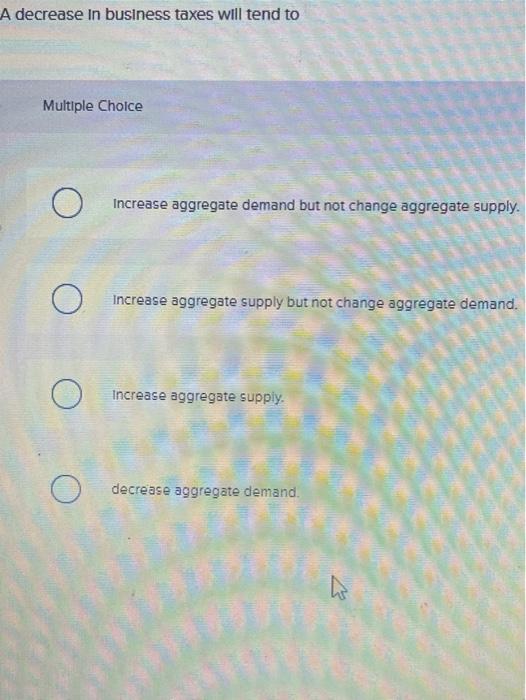

Business Economics Economics questions and answers A decrease in business taxes will tend to Multiple Choice O Increase aggregate demand but not change aggregate supply. The interest rate will also tend to increase c. Foreign buyers will buy less of our output and we tend to import more d.

Lower price level will decrease the real value of many financial assets and therefore cause an increase in spending. A decrease in business taxes will tend to A Increase aggregate demand but not A decrease in business taxes will tend to a increase School University of Tennessee Martin Course Title ECON 201 Type Test Prep Uploaded By KahlieAl Pages 94 Ratings 92 88 This preview shows page 67 - 70 out of 94 pages. Solved Question 9 1 Point Lower Taxes On Businesses Will Chegg Com Refund of real estate taxes.

A decrease in business taxes will tend to A increase aggregate demand and A decrease in business taxes will tend to a increase SchoolCalifornia State University Sacramento Course TitleECONOMICS 140 Uploaded Byteradactile23 Pages19 This previewshows page 12 - 17out of 19pages. A Decrease in Business Taxes Will Tend to - August 23 2022 Fourth there are many tax benefits that go with owning rentals. An increase in aggregate demand is most likely to be caused by an increase in.

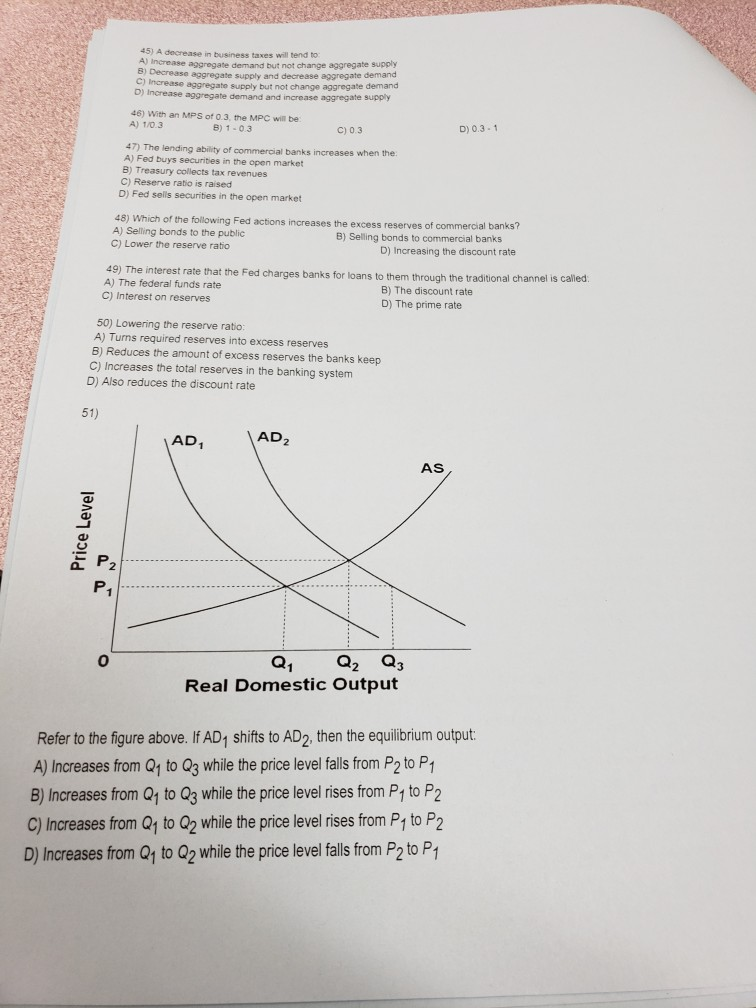

A decrease in business taxes will tend to. 45 A Decrease In Business Taxes Will Tend To 8 Decrease Aggregate Supply And Decrease C Increase Aggregato Supply But Not Change Aggregate Demand D Increase Aggregate Demand And Increase Aggregate A 103 47 The Lending Ability Of Commercial Banks Increases When Th Supply 46 With An MPS Of 03 The MPC Will Be S 103 C 03 D. Increase aggregate demand but not change aggregate supply b.

Lower price level will increase the real value of many financial assets and therefore cause an increase in spending. Our net exports will tend to decrease b. But the CGT is a tax on profit profits capital gains tax.

Decrease in the price level will decrease the demand for money decrease interest rates and increase consumption and investment spending The real-balances effect on aggregate demand suggests that a. An increase in expected future income will. A decrease in business taxes will tend to Select one a increase aggregate demand A decrease in business taxes will tend to select one School Highland Community College Course Title ECON 203 Uploaded By DoctorProtonOtter234 Pages 15 This preview shows page 8 - 12 out of 15 pages.

Up to 256 cash back Get the detailed answer. A decrease in business taxes will tend to. Increase aggregate demand and increase aggregate supply.

Lower price level will decrease the demand for money decrease interest rates and increase consumption and investment spending B. Decrease in aggregate demand. An increase in the real value of stock prices which is independent of a change in the price level would best be an example of the.

A decrease in business taxes will tend to. The commerce world is usually subjected to constant changes and it is important to be up to date with the latest trends. With the advancement in technology it has become easier for entrepreneurs to get the latest information about their.

Commerce Trends That Advertisers Need To Look Out For. O decrease aggregate demand. The purchasing power of peoples savings will increase.

Now there is a lot of debate about this. A decrease in business subsidies A decrease in business taxes will tend to. Some people say you need to pay tax on your profits to avoid paying the CGT.

A decrease in business taxes will tend to increase aggregate demand and increase aggregate supply The short run version of aggregate supply assumes that product prices are flexible and resource prices are fixed A decrease in personal income tax rates will cause a n increase or shift right in aggregate demand.

Solved 45 A Decrease In Business Taxes Will Tend To 8 Chegg Com

Reading Tax Changes Macroeconomics

Solved A Decrease In Business Taxes Will Tend To Increase Chegg Com

Solved Question 9 1 Point Lower Taxes On Businesses Will Chegg Com

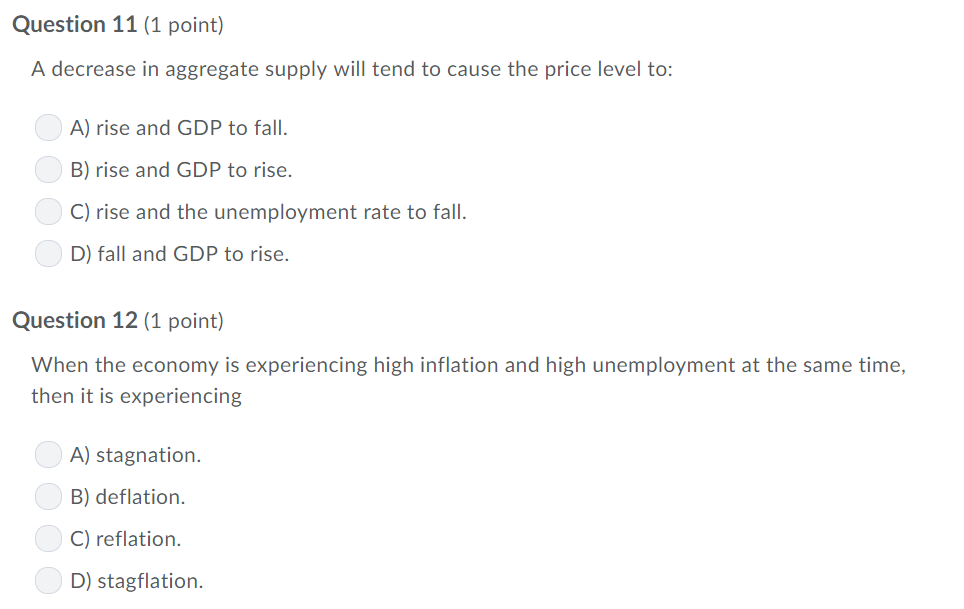

Solved A Decrease In Business Taxes Will Tend To Multiple Chegg Com

Solved A Decrease In Business Taxes Will Tend To Multiple Chegg Com

Comments

Post a Comment